ri tax rate income

Rhode Island state property tax rate. Ad Use Our Free Powerful Software to Estimate Your Taxes.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Effective tax rate 385.

. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Rhode Island State Personal Income Tax Rates and Thresholds. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator.

The rates range from 375 to 599. Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

2016 Tax Rates. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. About Toggle child menu.

All corporations with Rhode Island. Any sales tax that is collected belongs to the state and does not belong to the business that was transacted with. Income tax tables and other tax information is sourced from the Rhode Island Division of Taxation.

Rhode Island taxes most retirement income at rates ranging from 375 to 599. Exact tax amount may vary for different items. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

Though Rhode Islands property tax rates are high the state does offer some opportunities for exemptions and tax breaks. Any income over 150550 would be taxes at the highest rate of 599. DO NOT use to figure your Rhode Island tax.

Marginal tax rate 475. The tax breakdown can be found on the Rhode Island Department of Revenue website. It is one of the few states to tax Social Security retirement benefits though.

This income tax calculator can help estimate your average income tax rate and your salary after tax. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. Rhode Island Tax Brackets Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599.

65250 148350 CAUTION. There are three tax brackets and they are the same for all taxpayers regardless of filing status. Taxable income between 66200 and 150550 is taxed at 475 and taxable income higher than that amount is.

Your 2021 Tax Bracket To See Whats Been Adjusted. Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. 2022 Rhode Island state sales tax.

Total income tax -11081. The current tax forms and tables should be consulted for the current rate. Rhode Island Tax Brackets for Tax Year 2021.

Ad Compare Your 2022 Tax Bracket vs. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum. The rate so set will be in effect for the calendar year 2021.

Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Levels of taxable income. Discover Helpful Information And Resources On Taxes From AARP.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 375 475 599 on excess 0 65250 148350. Rhode Islands 2022 income tax ranges from 375 to 599. You would have some additional state only deductions and additions apply a single sales apportionment factor to arrive at your RI taxable income.

Now that were done with federal income taxes lets tackle Rhode Island state taxes. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of.

Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum. Rhode Island state tax 2693. State of Rhode Island Division of Municipal Finance Department of Revenue.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Rhode Island.

Rhode Island state sales tax rate. The highest state income tax rate was 99. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Residents of Rhode Island are also subject to federal income tax rates and. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

The income tax is progressive tax with rates ranging from 375 up to 599. 3 rows Rhode Island state income tax rate table for the 2022 - 2023 filing season has three. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax.

The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. IRS approved e-file provider. Rhode Island Income Tax.

Rhode Island also has a 700 percent corporate income tax rate. However the state changed its tax rules significantly in 2011 and these. The Rhode Island tax is based on federal adjusted gross income subject to modification.

Of the on amount Over But Not Over Pay Excess over 0 66200. Until 2011 Rhode Island residents paid relatively high income taxes. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

The first 66200 of Rhode Island taxable income is taxed at 375. Rhode Island state income tax rate. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Each tax bracket corresponds to an income range.

Individual Income Tax Structures In Selected States The Civic Federation

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

How Is Tax Liability Calculated Common Tax Questions Answered

How Big Is The Income Tax Gap In Your State

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Rhode Island Income Tax Brackets 2020

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Historical Rhode Island Tax Policy Information Ballotpedia

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Calculator Smartasset

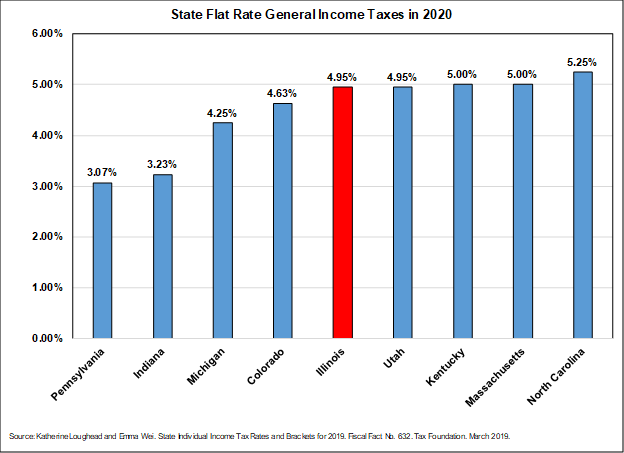

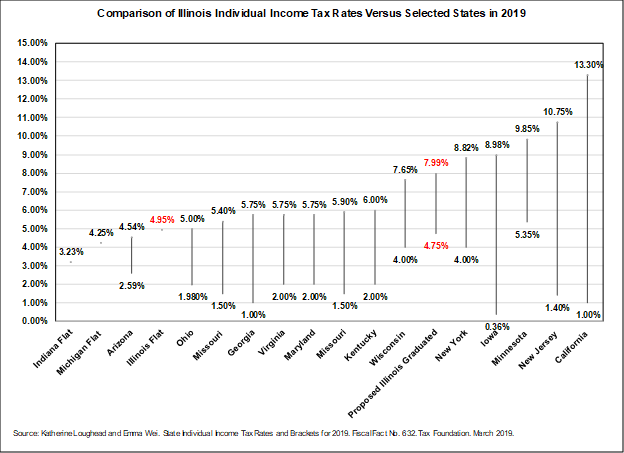

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com